I have friends who revel in arriving in a place and immediately investigating the neighborhood’s shortcuts, jogging down paths without a destination, wandering down wayward trails just to see where they lead. For those whose thirst for adventure is complemented by a healthy dose of spatial awareness and cognition, discovery is a thrill. Personally, I cannot relate to any of this. Nothing means less to me than the orientation of the sunrise and sunset. Your cardinal points are wasted on me, for I am a person endowed with no sense of direction whatsoever. Throw in any language other than my native fluency in French and English, along with a flailing Spanish, and my demise is guaranteed. Yet, in recent years, I have felt confident enough to explore places where I had never been before without knowing the local official language. In all this, my saving grace has been my iPhone—the powerful pocket-sized computer whose mapping and translating superpowers have convinced me almost no place is out of my reach. I’ll say it: I am a socialist and I love my iPhone.

This confession is music to the ears of the “capitalism made your iPhone” club. Indeed, proponents of capitalism often brandish rapid innovation as if it were an automatic checkmate on collectivist socioeconomic ideologies. To them, modern technology proves not only that capitalism works, but that it is the best system to stimulate innovation. The subtext of their retort is that a socialist economy could never generate technology this advanced. When coupled with a defense of “thought leaders” as obscenely rich as Steve Jobs, Elon Musk, and Jeff Bezos, their argument also contends that concentrating capital and power in the hands of a few billionaires is a small price to pay for the astronomical leaps in innovation from which we all benefit.

Capitalism’s fan base is not wrong that the iPhone, first released in 2007, is a product of America’s fiercely capitalist economy. I will also concede that without the vision of Steve Jobs, Apple’s late CEO and the 110th richest person in the world at his death, there would be no iPhone as we know it (although it is worth noting that the army of engineers and developers whose labor actually produced the iPhone might have come up with an equally wonderful smartphone). Nonetheless, their perspective is deeply misguided. It manages to both underestimate how much capitalism stifles innovation and misunderstand how much the fundamentals of a socialist economy make it the better system for stimulating innovation.

Innovation describes a four-step process that creates or ameliorates a thing or way of doing things. It begins with invention, the design of a device or process that did not previously exist in this form. The invention is then developed, meaning that it is improved with an eye towards eventual scaling, exchange or introduction on a market, and external use by others. At the production stage, the invention is built or reproduced. Finally, the invention is distributed to a wider audience. In our present economy, a minority of the innovation process happens at the individual level, from lonesome inventors and modern Benjamin Franklins who are able to conjure all sorts of contraptions in their garage. The majority, however, results from research and development (R&D) paid for by private firms, and by the public through government agencies, research institutions, and other recipients of federal and state funding.

The profit motive and exclusive proprietary rights are central to capitalist innovation. By law, private firms must prioritize the interest of their shareholders, which tends to be interchangeable with making as much money as possible. Accordingly, investments in any stage of the innovative process must eventually produce profits. To maximize profit, private firms jealously guard the value of their invention through regulations and restrictive contracts. Statutes and regulations help protect their trade secrets. The U.S. Patent and Trademarks Office routinely grants them utility and design patents that “exclude others from making, using, offering for sale, or selling … or importing the invention” for 20 years after the patent is issued. They enforce licensing agreements that can limit the uses and dissemination of all or part of their inventions. To further frustrate efforts to innovate on the back of their inventions, private firms subject their former employees to non-compete agreements that can severely limit them from using their knowledge and skills on competing projects for a period following their departure. Breaches carry dire consequences like expensive lawsuits, big money judgments, and other enormous hassles.

By contrast, the public sector innovates under an academic model instead of for profit. Certainly, earning tenure or an executive position can be lucrative. In some industries, a revolving door gives individuals the opportunity to innovate in both the private and public sectors throughout their careers. However, innovation in this area is less motivated by extracting profit, and more so by signifiers of prestige, career appointments, recognition, publication, project funding, and prizes.

The capitalist model has its perks. At present, private firms raise massive amounts of capital from the government to fund research, but also from banks, private equity, and wealthy donors. This vast amount of capital can prove lucrative for certain classes of workers. Innovative talent might accumulate wealth through generous compensation packages, which play an important role in attracting and retaining them.

Private firms also boast a terrifying nimbleness that allows them to push projects and respond to change faster than government institutions. For instance, firms can turn over staff quickly if their industry in the absence of unions and norms against firing workers at will, other than the standard prohibitions against discriminatory practices. In other words, without the regulatory and administrative constraints that saddle publicly funded projects, private firms can move through the innovative process faster.

Another advantage of the capitalist model is that profits—potential and actual—provide some measure of how well a company is innovating. Particularly, for the many private firms that sell some of their shares to the public on stock exchanges, prices serve as a form of feedback from investors and the market. Imagine that a publicly-traded retailer announces the imminent launch of an affordable, solar-powered computer that boasts power and speeds to rival Apple’s newest models. In the hours following the press release, the retailer’s stock value triples. A week later, while at a tech conference in the Colorado mountains, the retailer’s CEO lets it slip that the first prototype will actually retail for about four thousand dollars. Unfortunately for the CEO, he was wearing a hot mic. The quote is made public in an article titled “No debt-saddled, environmentally-conscious millennial will shed $4,000 for a computer!” The stock value immediately plummets by 200 percent.

The original rise in the retailer’s share value communicates that investors believe in the product as a profitable enterprise, and that they see this type of innovation as a worthwhile pursuit. The drop, on the other hand, suggests that they believe this specific product would be more marketable and therefore more profitable if it were developed for an audience beyond high-end consumers. The turn in the stock value can embolden the retailer—through its management, Board of Directors, or shareholders—to revisit its plan to innovate. It also signals to competitors that their innovation of a similar product could be well received, especially if they can overcome the original product’s weaknesses.

But prioritizing profit is a double-edged sword that can hamper innovation. Owning the proprietary rights allows private firms to block workers—through anti-competitive tools like non-compete agreements, patents, and licenses—who put labor into the innovation process from applying the extensive technical expertise and intimate understanding of the product to improve the innovation substantially. This becomes especially relevant once the workers leave the firm division in which they worked, or leave the firm altogether. Understandably, this lack of control and ownership will cause some workers, however passionate they may be about a project, to be less willing to maximize their contribution to the innovation.

Of course, the so-called nimbleness that allows firms to make drastic changes like mass layoffs is extremely harmful to the workers. This is no fluke. The capitalist economy thrives on a reserve army of labor. Inching closer to full employment makes workers scarcer, which empowers the labor force as a whole to bargain for higher wages and better work conditions. These threaten the firm’s bottom line. So, the capitalist economy is structured to maintain the balance of power towards the owners of capital. Positions that pay well (and less than well) come with the precariousness of at-will employment and disappearing union power. A constant pool of unemployed labor is maintained through layoffs and other tactics like higher interest rates, which the government will compel to help slow growth and thereby hiring. This system harms the potential for innovation, too.

The fear of losing work can dissuade workers from taking risks, experimenting, or speaking up as they identify items that could improve a taken approach—all actions that foster innovation. Meanwhile, thousands of individuals who could be contributing to the innovative process are instead involuntarily un-employed. This model also encourages monopolization, as concentrating market power gives private firms the most control over how much profit they can extract. But squashing competition that could contribute fresh ideas hurts every phase of the innovation process, while giving workers in fewer workplaces space to innovate.

Deferring to profit causes many areas of R&D to go unexplored. Private firms have less reason to invest in innovations likely to be made universally available for free if managers or investors do not see much upside for the firm’s bottom line. In theory, the slack in private research can be picked up by the public sector. In reality, however, decades of austerity measures threaten the public’s ability to underwrite risky and inefficient research. Both the Democratic and Republican parties increasingly adhere to a neoliberal ideology that vilifies “big government,” promotes running government like a business, pretends that government budgets should mirror household budgets or the private firm’s balance sheet, and rams privatization under the guises of so-called public-private partnerships and private subcontractors.

In the United States, public investment in R&D has been trending downward. As documented in a 2014 report from the Information Technology & Innovation Foundation, “[f]rom 2010 to 2013, federal R&D spending fell from $158.8 to $133.2 billion … Between 2003 and 2008, state funding for university research, as a share of GDP, dropped on average by 2 percent. States such as Arizona and Utah saw decreases of 49 percent and 24 percent respectively.” Even if public investment in the least profitable aspect of research suddenly surged, in our current model, the private sector continues to be the primary driver of development, production, and distribution. Where there remains little potential for profit, private firms will be reluctant to advance to the next phases of the innovation process. Public-private projects raise similar concerns. Coordinated efforts can increase private investment by spreading some costs and risk to the public. But to attract private partners in the first place, the public sector has a greater incentive to prioritize R&D projects with more financial upsides.

This is how the quest for profits and tight grip over proprietary rights, both important features of the capitalist model, discourage risk. Innovations are bound for plateauing after a few years, as firms increasingly favor minor aesthetic tweaks and updates over bold ideas while preventing other avenues of innovation from blossoming. At the same time, massive amounts of capital continue to float into the hands of a few. The price of innovating under capitalism is then both decreased innovation and decreased equality. The idea that this approach to innovation must be our best and only option is a delusion.

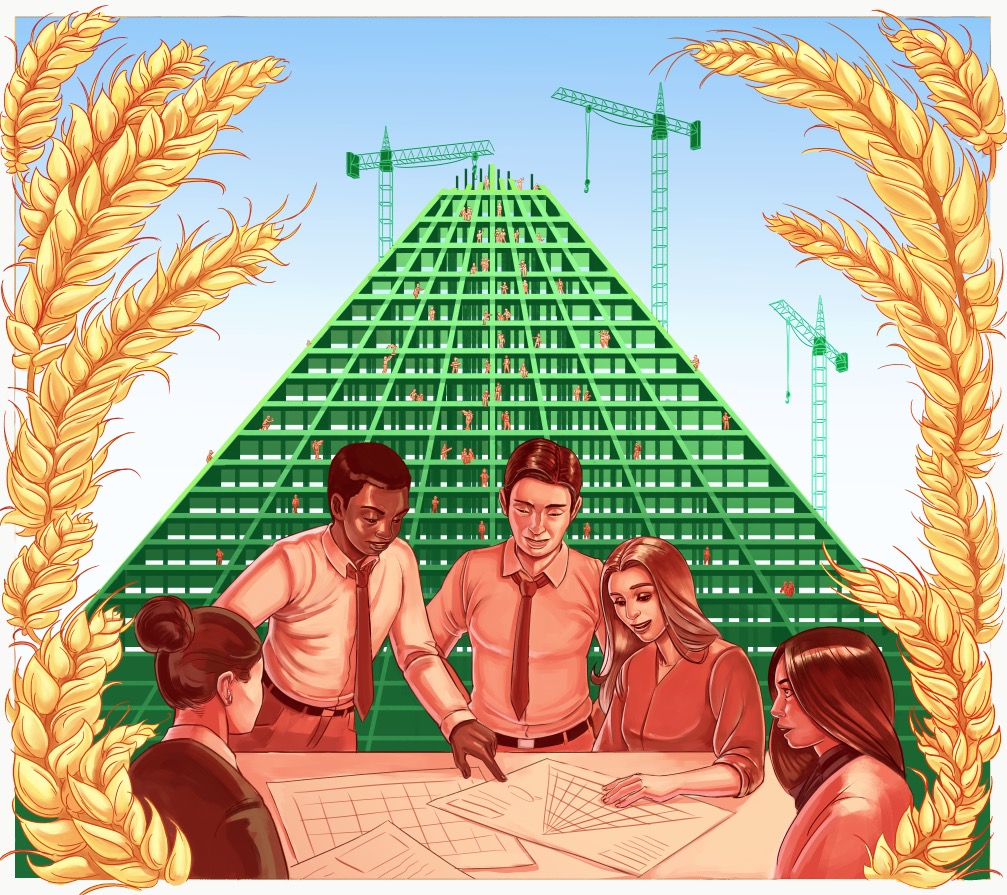

As I see it, four ingredients are key to kindling innovation. First, there must be problems requiring solutions (an easy one to meet). Second, there must be capital and resources available to invent, develop, produce, and distribute the innovative product. There must also be actual human beings available to participate in every phase of the innovation process. And fourth, at least some of these human beings must have the creativity and motivation to participate in the innovation process. The question isn’t really whether a socialist economy can provide these four ingredients at all (it can) but rather, whether it can innovate better than a capitalist economy (it can).

Adherents of the capitalist model like to point to boogeymen like the Soviet Union to argue that a collectivist economy cannot both innovate and create a society in which people do not live on food rations under authoritarian rule. To be sure, this argument shows little interest in understanding the contextual factors that have led to extreme poverty and authoritarianism in other nations. It also ignores the extreme poverty in the United States, and the deeply undemocratic currents in our own system of government. But more importantly, it completely misses the fact that socialism is a social and economic ideology—not a fixed set of systems and institutions. Nothing prescribes that socialist ideology must take on a precise form, or that it must look exactly like models previously attempted. Nor are the conditions that once produced undesirable results—be they historical, geographical, fiscal, demographical, or other—inherent to the socialist economic model. (The same cannot be said of capitalism. Its greatest flaw, maximizing profit, is also its primary goal.)

Just a basic search for “types of socialism” on Wikipedia brings up a list of over 30 variants ranging from Maoism to anarcho-syndicalism. These strains tend to share a set of ideological tenets. According to the economist Al Campbell from the University of Utah, the broadest and most common list comprises of: self-governance or democracy, the development of human potential, equality, solidarity, and, traditionally, nationalizing the means of production. Other values on the list have included individuality, privacy, liberty, and autonomy. Inevitably, some models of socialist economies will be more conducive to achieving all or most of these principles. A subset of these models—including, in my opinion, market socialism—are particularly conducive to creating the right conditions for maximizing innovation.

To be clear, socialists have differing and sometimes very strong views about whether markets are compatible with socialism. Reasonable minds can certainly disagree. But my personal belief is that markets are politically neutral tools that can be molded to advance any purpose, like an alphabet with which we can communicate in many languages and genres. It would be absurd to conclude that because the alphabet wrote a book as odious as Mein Kampf, our utopian society should have no alphabet. Similarly, markets can be repurposed to advance a socialist principles. Moreover, a market socialist economy—or any other type of socialist economy—can be hybridized to incorporate features of what other socialist models do better.

Consider a market socialist economy that somewhat resembles the proposal by economics professors Pranab Bardhan and John Roemer. In this scheme, firms of a certain size are owned wholly, or in the combination, by the government, the firm’s workers, “other public firms (including their workers) in the same financial group, together with the main investment bank and its subsidiaries.” The bank, too, is owned by a combination of these same shareholders although the government is its largest owner if not the only one. The firms are jointly owned through shares, which are distributed to every citizen (and whomever else we democratically decide to include) with the exception of children, for whom the shares are held in trust until adulthood.

In this market socialist society, most shares are pooled into highly regulated mutual funds, which then pursue different investment strategies when trading them on a highly regulated stock exchange. This exchange helps monitor the performance of the firm managers and assess which innovations are performing strongly. To avoid the concentration of market power and capital, the government sets the bar for how much stock any stakeholder can hold in any firm and industry. It also sets the minimum and maximum amount of dividends that each person can receive annually. As the economy grows, dividends can be adjusted to increase by a percentage, or commensurate with inflation. Surplus resulting from distributing only part of the profits allows the more profitable firms to subsidize innovative, but less profitable, activities. In addition, this regime does not tolerate anti-competitive contracts like restrictive employment agreements, strict license agreements, and long patents (although inventions may be attributable to their inventors and may be rewarded through other means like prizes, bonus compensation, or simply very short patents periods).

The model could incorporate elements of democratically-planned, participatory socialism, which emphasizes democracy and individual autonomy in the workplace. Economist David Kotz believes that particular features of this model could foster innovation performance:

First, the main features of the overall economic plan would be determined by a democratic process … Second, the planning and coordination of the economy would take place … by industry boards and local and regional negotiated coordination bodies that have representation of all affected constituencies, including workers, consumers, suppliers, the local community, and even “cause” groups such as environmentalists, job safety activists, feminists, etc.

Among other topics, these representative boards could vote on compensation minimums and maximums, to prevent innovation from supporting socioeconomic inequality and unfair social divisions of labor. This injection of democracy would give ordinary people a larger say in the direction of the markets, and what areas they think would benefit from more investment in innovation.

The second ingredient of innovation, capital, is guaranteed in the market socialist economy. Freed of its neoliberal handcuffs, the government can designate funding towards various innovative projects at a greater rate than it does now. Banks jointly owned by the government and other non-private stakeholders would provide entrepreneurs with access to capital for projects through loans with terms more generous than private lenders offer now. The firms owned by government, worker co-operatives, ordinary people, and other publicly-owned firms can also raise capital from each other as wealth is distributed more equally. In such a world, more individuals can pool their resources to invest in particular innovative projects rather than a recurring cast of millionaires.

Market socialism would easily deliver the third ingredient of innovation: human capital. Such an economy has no need for a reserve army of labor. While profit is encouraged, its primary function is increasing the pool of resources and cash distributable to workers and non-workers. It does not come at the price of providing generous wages, as dividends to shareholders are capped no matter how well the firm performs. In fact, this society could make a democratic decision to compensate people in positions on the lower band of wages with more in unearned income, out of the same pool of profits.

When applied earnestly, the principles of socialism are also incompatible with mass incarceration, discrimination, uncompensated caregiving, highly restrictive immigration policies, and other social practices that exclude large numbers of workers from participating in our capitalist economy. Add a fairer distribution of public resources among individuals and communities, along with more free or heavily subsidized goods like education, and a market socialist economy could really see an increase in the availability and skills in the pool of workers. Freeing more people to join the innovative process would naturally foster more innovation.

Lastly, innovation can only thrive if the innovation process affords individuals chances to be creative and the right conditions to motivate them. Studies on what fosters creativity show that workers who rate highly on creativity indexes perform best when they are given challenging work, a good measure of autonomy, and supportive and caring supervisors who can provide substantive and constructive feedback. The same study, however, shows that workers who are by nature less creative tend to be happier in less complex positions. Neither worker is, or should be, superior to the other. On the contrary, the innovation process has plenty of room for all types of workers with varying degrees of innate creativity. The core principles of socialism, however, do suggest that this economic system is better suited for supporting creative workers than capitalism.

Of course, to be creative, workers must also feel motivated. Capitalism tells us that competition and compensation are the best motivators. While this is inevitably true for some individuals, the case of open source innovation is proof that motivation can rate high without either. Indeed, for the last three decades, developers and users have volunteered code to free, collaborative software projects. When researchers asked them why they devote so many hours of their free time to open source projects, these contributors explained that they mostly participated because they liked coding. To many, this work felt like an artistic endeavor. They valued “the freedom and creativity they experienced in defining and managing their open source work,” and felt good about identifying and solving problems. They enjoyed the reciprocity aspect of the project—answering a question or solving a problem after the same was done for them. But they also tended to dislike communities with more top-down control and limited ownership over the project. A number of the coders surveyed reported withholding contributions where these factors were present. In other words, the factors that motivated them were far closer to the principles espoused by socialists, than by the capitalist obsession with profit.

What all this tells us is that we can have our cake and eat it too. Living with inventions like the iPhone and an unequal and undemocratic economy obsessed with profits is a political choice. It is not our only option. We can strive for a fairer economy, under a socialist model, without conceding the technological advances that have made our lives easier. The ingredients are all there. It only takes a little imagination.

If you appreciate our work, please consider making a donation, purchasing a subscription, or supporting our podcast on Patreon. Current Affairs is not for profit and carries no outside advertising. We are an independent media institution funded entirely by subscribers and small donors, and we depend on you in order to continue to produce high-quality work.